Money and financial matters can often become a source of tension in families, especially for women who may find themselves financially vulnerable in certain situations. Studies show that a significant proportion of women rely on their husbands for financial support, which can leave them in precarious positions, especially in the event of divorce. Therefore, it is crucial for women to have their own financial backup so that they can remain financially independent and stable if their relationship runs into trouble.

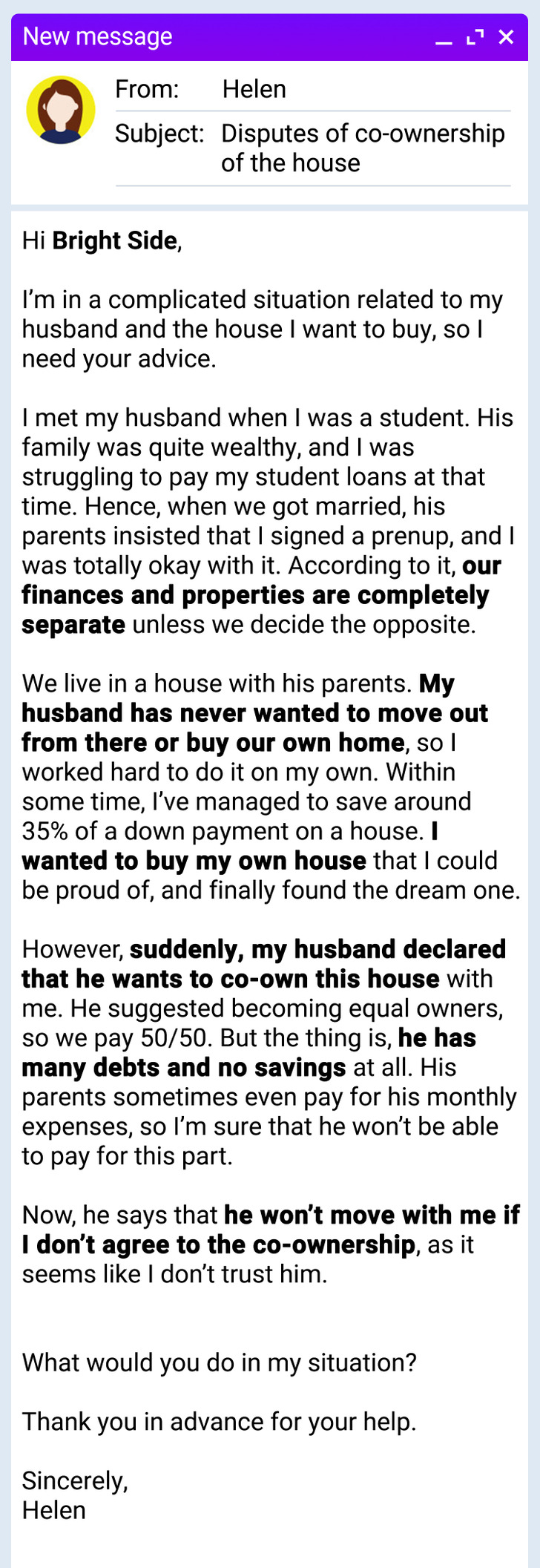

One Bright Side reader shared her story and expressed her desire to retain sole ownership of her home despite being happily married. Our team at Bright Side was eager to provide her with advice to help her navigate this situation and assert her independence. Here’s what we recommend:

First of all, it is necessary to assert your right to buy a house and have it exclusively in your name. While no one expects their marriage to end, it is wise to consider the possibility and ensure that each partner has financial security in the event of a separation. Regardless of the love between partners, it is essential to have a backup plan so that one does not find himself without a place to live.

Sometimes money and financial matters can cause problems in family relationships. Women in particular face vulnerability in this

to consider Research shows that about one-third of women rely on their husbands for money, which can lead to financial difficulties in the event of a divorce. Having your own financial backup is therefore crucial to staying afloat if your relationship turns sour.

A reader told his Bright Side story. She is happily married but does not wish to own a house with her husband together. Her situation is described below.

Our team at Bright Side was excited to offer some advice to help a woman solve this problem. Here’s what we came up with.

To begin with, we would like to emphasize that it is entirely your right to purchase a home and have it solely in your name. Even if we don’t expect our marriages to end, it is essential to consider what each of us would have in terms of money and assets if it were to end. So no matter how much love there is for your partner, it’s always a good idea to have a backup plan so you don’t find yourself without a place to live.

Remember the prenuptial agreement you both signed before you got married? Your husband inherited a substantial amount from his parents and you fully supported this choice at the time. Now you seek the same understanding from him. Under the original agreement, ownership of separate properties is within your rights.

Engage in a conversation with him and clarify your personal ambitions, which you want to pursue independently. Make sure he understands the meaning of your dreams and desires for you. Highlight your achievements since graduation and how you achieved them yourself. Let him know that this dream house is like a symbol of your hard work and the journey you have taken.

Be honest with him about his point of view approach his financial situation with respect and avoid any embarrassment. The idea is to help him understand that he has his parents’ house as a financial safety net while you lack your own safety net if you ever decide to separate or unexpected events occur. You can gently bring up his credit card debt and the times his parents had to help with expenses. It suggests that this may not be the ideal moment to commit.

It is important to realize that insisting on co-ownership as a condition for moving in may be a form of manipulation. Sometimes those closest to us use emotional tactics to create guilt and get their way. Tell him that manipulation has no place in your relationship and that financial matters should not be used as a test of trust. Next, remind him that he didn’t want to buy a house in the first place, which is what led you to decide to buy your own house.

If you agree to your husband’s request for joint ownership of the house, it is a good idea to seek expert legal advice.

There may be legal avenues to ensure that they fulfill their obligation to pay half of the cost of the house. This may include a legally binding agreement stating that you will retain sole ownership if he defaults on his financial obligation. Consulting with a legal representative can help you effectively navigate this process.

It’s not always easy to navigate married life, and here’s another Bright Side reader who wrote in asking for advice. She opened up about her husband asking her to make dinner and then leaving to eat at his mother’s. Read the full story here.

In conclusion, financial independence and security are fundamental aspects of any relationship, especially when it comes to property ownership. While navigating this situation can be challenging, open and honest communication with your partner is key. By respectfully expressing your concerns and desires, you can work toward a solution that ensures your financial well-being while maintaining the strength of your relationship. Remember to seek legal help if necessary to protect your interests and rights.