Understanding financial principles and developing sound money management skills is essential for everyone, especially young adults who are just beginning to navigate the complexities of personal finance. Unfortunately, studies have shown that a significant portion of young adults lack economic stability, financial literacy, and the ability to make wise financial decisions. It is essential to address these gaps by educating yourself and others in a timely manner about responsible money management practices.

One of the mistakes often highlighted is the tendency to compare yourself financially to wealthier peers and try to keep up with their lifestyles. This often leads to overspending and debt accumulation. Learning to live within your means and prioritize financial stability over appearance is the key to long-term financial well-being.

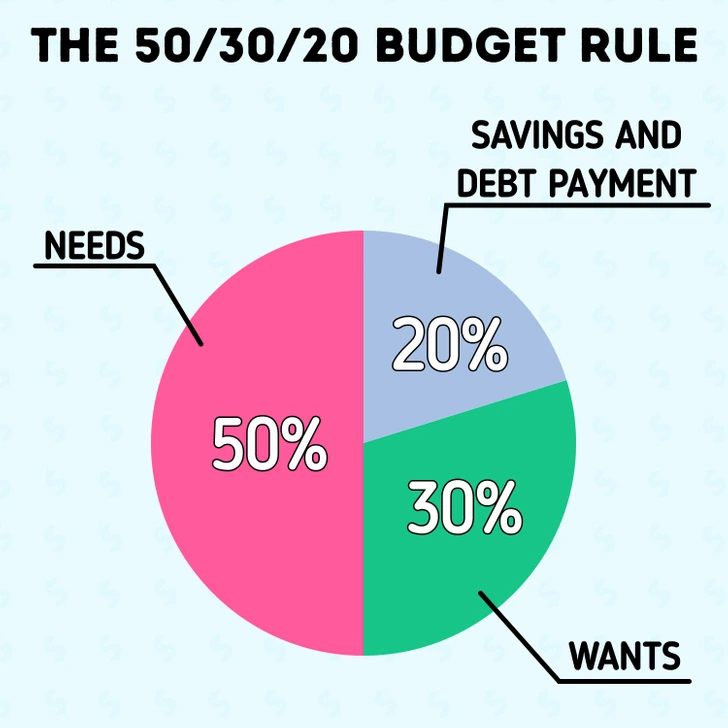

Proper budgeting is another essential aspect of financial management that many young adults overlook. The 50/30/20 budgeting rule, allocating 50% of income to necessities, 30% to discretionary spending, and 20% to savings and paying down debt, can provide a clear framework for effective financial management.

Additionally, the importance of planning for the future, including saving for retirement and insurance, cannot be overstated. Starting contributions to retirement accounts early and securing adequate insurance coverage can provide financial security in the face of unforeseen events.

This study shows that nearly one-third of young adults lack economic stability, good money management practices, and financial literacy. Everyone should learn to manage their finances responsibly and make wise financial decisions at a young age. The best thing we can do to stay out of trouble is to try to educate ourselves before we go out into the world and manage our finances.

Bright Side would like to help you in this learning process by highlighting 11 common financial mistakes young people make.

1. They try to stay with friends who are richer

Spending time with friends who are wealthier than us can make us want to keep up with them, buy high-end vehicles and clothes, and plan extravagant international trips.

Knowing your limit and staying out of debt is essential if you want to live the same lifestyle as someone who is well-off. After all, some people achieve success and wealth at different stages of their lives, so we should be wise about them.

2. It is not allocated correctly

It will be essential for you to learn how to manage your money as soon as possible. The 50/30/20 budget rule is actually a straightforward guideline that can be followed for greater financial security. 50% of your income should go towards bills, rent, food, and transport; 20% should go towards debt repayment and savings; and the remaining 30% should be yours to do with as you choose.

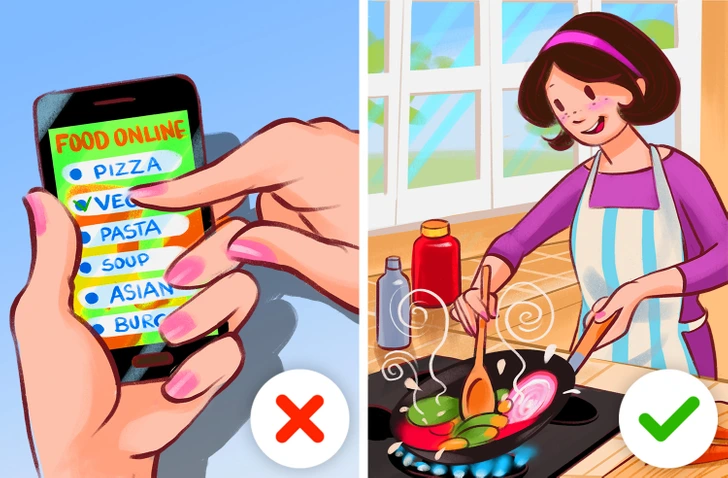

3. I always get takeout.

If you live far from home and don’t have constant access to home-cooked hot meals, you may find yourself ordering takeout repeatedly. This means you will start splurging on food and may not have enough income to support it. Rather, head to the grocery store, pick up what you need, and prepare your own meal. If you are not a good cook, you should try to learn.

4. Getting a credit card in advance

Getting a credit card at an early age can benefit your credit if you use it responsibly. It is better to wait until you have a well-paying job if you feel the urge to buy a lot of goods but cannot afford to pay for them monthly.

5. Not making retirement plans

When you’re in your twenties and living the good life, you might not want to think that far ahead, but that would be a mistake. Start contributing to a retirement account as soon as you can. Interest will accrue over time, giving you plenty of money to enjoy in your old age.

6. Regardless of insurance

You may feel like a superhero in your 20s, but you’re not invincible, and you shouldn’t assume that you’re completely immune to illness, accidents, natural disasters, and other problems. It is not wise to ignore insurance. For example, renter’s insurance can help you save money in the event of an emergency such as a flood, fire or burglary. Health insurance could save you thousands of dollars in an emergency. It is important to take all reasonable precautions to ensure your safety.

7. Refusal to take risks at an early age

Even though you may not enjoy your current job, when you drive for Uber or Lyft or work in retail, you are afraid to leave because you feel secure in the position and have a steady income. But if it’s not your dream, you shouldn’t be afraid to take a chance, especially if you’re in your 20s, even if it means doing an internship.

If the internship is focused on a career you like and would love to do, you shouldn’t be afraid to start over if it means it will improve your future. It could not be paid, or it could pay less. Besides, learning a business in your 20s is the best time to do it; it is better to start now than to have to change careers much later in life.

8. Getting a pet too young.

After you’ve moved into your own home, getting a pet may seem like the next natural step to your independent existence, but it may not be the best decision.

It’s not all fun and games, even though they’re your best buddies, they’re cuddly and make for amazing photos. Because they have their own requirements, pet care can be incredibly expensive. Including food, toys, shots, vet costs and care if needed. You should think about whether you can afford to buy and care for a pet, as it is a very huge and vital responsibility. These costs add up and can absorb a significant portion of your income.

9. Investing money to fulfill personal desires

It is likely that many of us have bought unnecessary things out of sheer sadness. The truth is, while these purchases may temporarily lift our spirits, they won’t solve our problems; instead, they just force us to spend money that we could use for more essential needs. Self-care is vital and generally beneficial, but it must be done sensibly.

10. Leaving too early

You may think that you should move out of your parent’s house and become independent and on your own in the big world once you turn 18 or 21. It is beneficial to gain independence and the ability to take care of yourself, but you should be careful that way. You would have to learn to cook for yourself and pay your rent and bills, and your first home might not be as nice and comfortable as the one you grew up in if you moved away. As you take this crucial step in your adult life, keep these points in mind. It is also acceptable to delay moving until you have a decent job and steady income. You’ll feel a lot better at that point because you’ll have the resources to take care of yourself.

11. You think you’ll have it figured out by 20

Many young people feel worried and anxious about their lives and issues, including paying for education, work, rent, or all of the above. Few people discover their passion, get off to a great start in adulthood, and seem to have it all together. It’s common to assume that your first job would be fantastic, well-paying and the start of your dream career, but that’s okay because it won’t always be that way. You’ll be moving jobs, moving apartments, and dealing with your car breaking down, but all these experiences will come in handy in the end. You’ll figure it out in time, so it’s okay not to know where you’re going or what you’re doing.

Bonus: True story

My ex-husband and I decided it would be easier to save money if I paid all our bills from my salary and he handled major purchases, savings, and tax returns with his.

After our divorce, he left me half of the unpaid taxes. And all that money he was saving? Yeah, that was money I didn’t get either. However, his new bride was given a honeymoon and a beautiful ring.

I will never trust anyone with my money again.

All or nothing, half-heartedly.

What financial knowledge do you wish you had when you were younger? And what advice would you give to the young generation who are just starting to learn about money management?

Understanding financial principles and developing sound money management skills is essential for everyone, especially young adults who are just beginning to navigate the complexities of personal finance. Unfortunately, studies have shown that a significant portion of young adults lack economic stability, financial literacy, and the ability to make wise financial decisions. It is essential to address these gaps by educating yourself and others in a timely manner about responsible money management practices.

One of the mistakes often highlighted is the tendency to compare yourself financially to wealthier peers and try to keep up with their lifestyles. This often leads to overspending and debt accumulation. Learning to live within your means and prioritize financial stability over appearance is the key to long-term financial well-being.

Proper budgeting is another essential aspect of financial management that many young adults overlook. The 50/30/20 budgeting rule, allocating 50% of income to necessities, 30% to discretionary spending, and 20% to savings and paying down debt, can provide a clear framework for effective financial management.

Additionally, the importance of planning for the future, including saving for retirement and insurance, cannot be overstated. Starting contributions to retirement accounts early and securing adequate insurance coverage can provide financial security in the face of unforeseen events.

Avoiding impulse spending on unnecessary items and understanding the true costs of pet ownership are also essential lessons in financial responsibility. In addition, it is essential to realize that financial stability takes time and effort and there is no need to rush into financial independence without adequate preparation.

Finally, the shared personal story underscores the importance of financial transparency and trust in relationships, encouraging individuals to be vigilant and informed about their financial affairs.

In conclusion, developing financial literacy and responsible money management habits at an early age can lay the foundation for a secure and prosperous financial future. By learning from common financial mistakes and seeking knowledge and advice, individuals can navigate financial challenges with confidence and make informed decisions that benefit their long-term financial well-being.