Before diving into the details of Bernie Madoff’s notorious Ponzi scheme, it is worth noting the profound impact his actions had on countless individuals and families. The Madoff investment scandal not only resulted in significant financial losses for investors but also eroded confidence in the financial system and left a lasting legacy of disillusionment and betrayal. As we examine Madoff’s life and the scandal that defined it, it’s important to keep in mind the very real consequences faced by those who fell victim to his fraudulent practices.

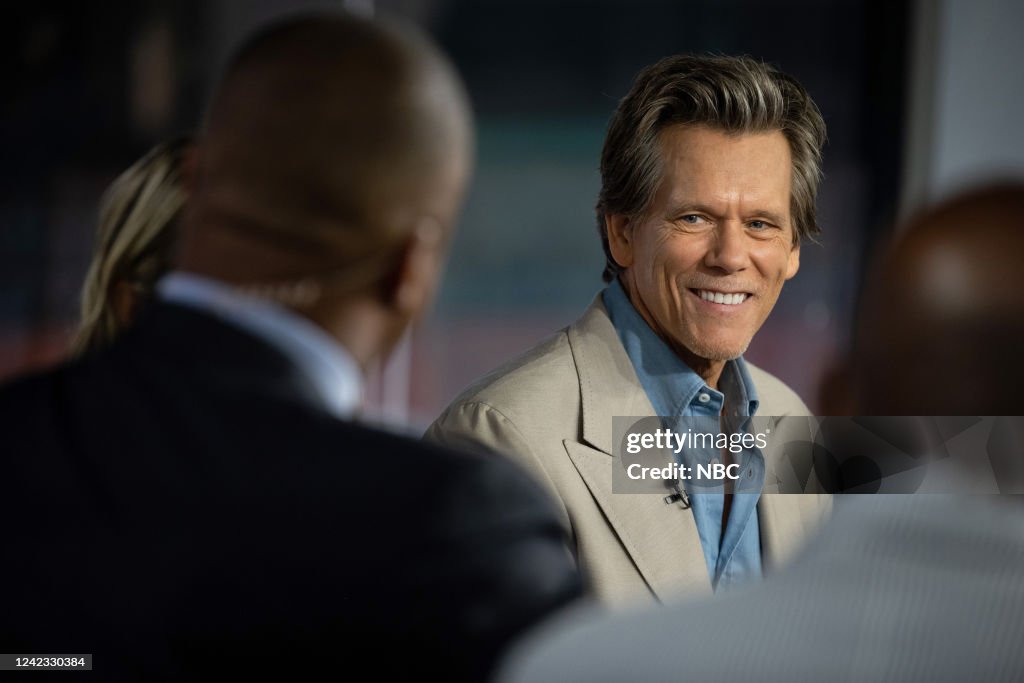

This Hollywood icon learned something very surprising about his family history, especially regarding his marriage to Kyra Sedgwick.

The actor, 64, opened up about the botched investment and how he and his wife almost lost everything.

Keep reading to learn more.

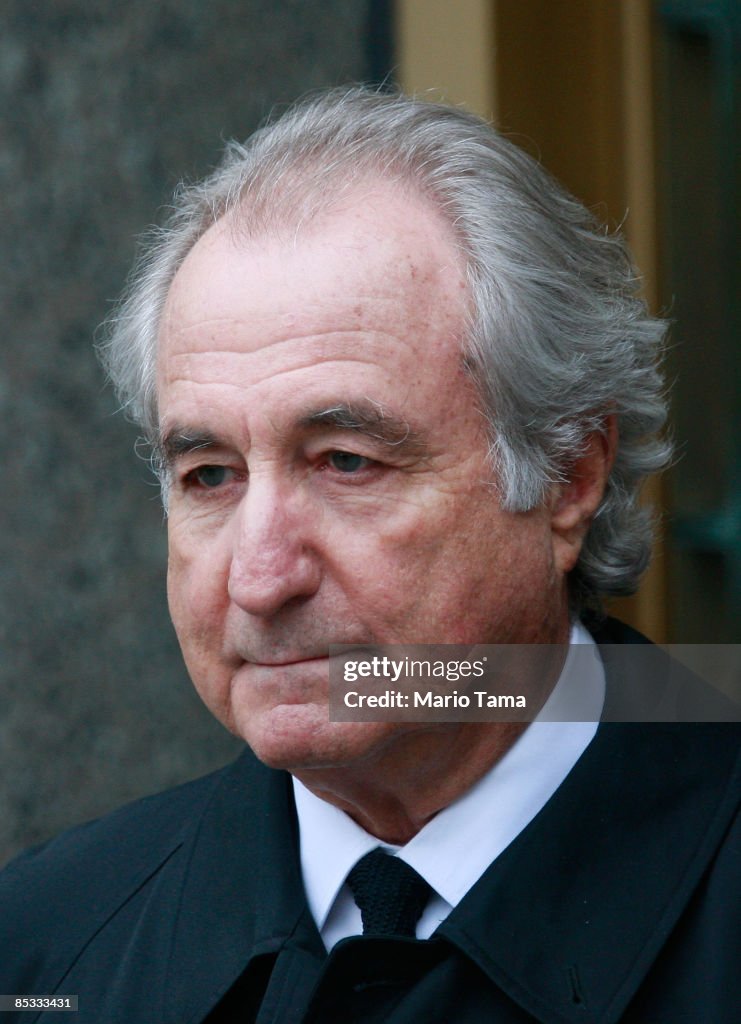

American financial fraudster Bernie Lawrence Madoff was a fraud.

He died last April while being held at a federal prison in North Carolina, according to a confirmation from the Federal Bureau of Prisons.

After being found guilty in a criminal case in 2009, Madoff was serving a 150-year sentence.

Reactions to the death of the controversial figure were very varied.

He became infamous for running a massive Ponzi scheme that defrauded investors of billions of dollars over a long period of time.

Kidney failure is believed to have caused his death.

The Madoff investment scandal in late 2008 was a high-profile case in stocks and securities.

American financier Bernie Madoff ran the biggest Ponzi scheme of all time.

Over the course of at least seventeen years, he defrauded hundreds of investors out of tens of billions of dollars.

Some speculate that he may have prolonged the deception.

He wasn’t just a financier; he chaired the Nasdaq stock exchange in the early 1990s and was a pioneer in computerized trading.

On April 29, 1938, Madoff was born in Brooklyn to parents Ralph and Sylvia Madoff.

His father was a plumber before he and his wife went into the financial industry.

They founded Gibraltar Securities, which was eventually forced to close by the SEC.

Madoff graduated with a bachelor’s degree in political science from Hofstra University in 1960 when he was twenty-two years old.

He also studied law at Brooklyn Law School. However, it was only for a short time.

Ruth, Madoff’s high school friend, was married when he was a college student.

The same year he received his degree, he went on to found Bernard L. Madoff Investment Securities.

When he first started his business, he used the $5,000 he earned from installing sprinklers and working as a lifeguard to trade pennies.

However, as he became more and more confident in his business…

He started luring friends, relatives, and acquaintances to join him in investing.

During his career, Madoff achieved a number of notable achievements.

When he and his brother started developing e-commerce options, they were successful.

or what Madoff referred to as “artificial intelligence.”

It brought in a lot of orders and increased sales by giving the company information about what was happening in the market.

According to Madoff during a press interview with Steve Fishman, “All these big banks came down and entertained me.

His fraud, scandal, and insult…

At one point, Madoff attracted investors with promises of consistent and substantial profits using a sound trading technique known as “split conversion.”

However, Madoff paid existing clients who wanted to cash out by placing client money in a single bank account.

On December 10, 2008, he told his boys about his mistakes.

They handed him over to the police the next day.

Madoff has never wavered in his denial that his sons were complicit in his fraud.

After receiving a prison sentence,

Madoff was ordered to repay investors $170 billion.

In order to repay this money, his assets – including jewelry, yachts, and real estate – were taken from him.

Several people suffered from the dispute.

In closing, the recent death of Bernie Madoff, mastermind of one of the largest Ponzi schemes in history, serves as a sobering reminder of the devastating impact financial fraud can have on countless lives. Madoff’s fraudulent practices not only defrauded investors out of billions of dollars but also left a trail of destruction in his wake, tarnishing the reputation of the financial industry and causing irreparable harm to his victims. The Madoff investment scandal that unfolded in late 2008 exposed vulnerabilities in the financial system and highlighted the need for increased regulation and oversight to prevent such outrageous schemes from occurring in the future. Madoff’s death, while bringing closure for some, also reignited discussions about accountability, justice, and the lasting consequences of his actions. As we consider Madoff’s legacy, it is essential to remember the individuals and families who suffered enormous financial losses as a result of his deception. Their stories serve as a poignant reminder of the importance of transparency, integrity, and ethical behavior in all aspects of the financial world. Let’s try to learn from these lessons and work to build a fairer and more trustworthy financial system for future generations.